Mass tax connect has emerged as a revolutionary solution for simplifying tax processes in Massachusetts. As the state continues to modernize its tax infrastructure, this digital platform is playing a pivotal role in streamlining tax filings, payments, and audits for both individuals and businesses. With features designed to enhance transparency and accessibility, mass tax connect is not just a tool but a pathway toward a more efficient tax system. Whether you're a small business owner, a freelancer, or an individual taxpayer, understanding how mass tax connect works can significantly improve your tax compliance experience.

For many taxpayers, navigating the complexities of state tax regulations can be daunting. The introduction of mass tax connect aims to address these challenges by offering a user-friendly interface that simplifies the tax filing process. By leveraging cutting-edge technology, this platform ensures that taxpayers have access to real-time updates, accurate information, and seamless communication with state tax authorities. Moreover, its ability to integrate with existing accounting software makes it an invaluable resource for businesses looking to optimize their financial operations.

As we delve deeper into the world of mass tax connect, it becomes evident that its benefits extend beyond mere convenience. This platform fosters trust between taxpayers and the government by promoting transparency and accountability. It also empowers users with tools to manage their tax obligations more effectively, reducing errors and minimizing the risk of penalties. In this article, we’ll explore the various aspects of mass tax connect, including its features, advantages, and potential drawbacks, to provide a holistic understanding of its impact on the Massachusetts tax landscape.

Read also:Exploring The Tickle Community Vk A Comprehensive Guide

What Is Mass Tax Connect?

Mass tax connect is a digital platform developed by the Massachusetts Department of Revenue (DOR) to facilitate tax-related activities for residents and businesses. Launched as part of the state's broader initiative to modernize its tax infrastructure, this platform serves as a centralized hub for all tax-related matters, from filing returns to managing payments and resolving discrepancies. By integrating advanced technologies such as artificial intelligence and data analytics, mass tax connect ensures a streamlined and secure experience for users.

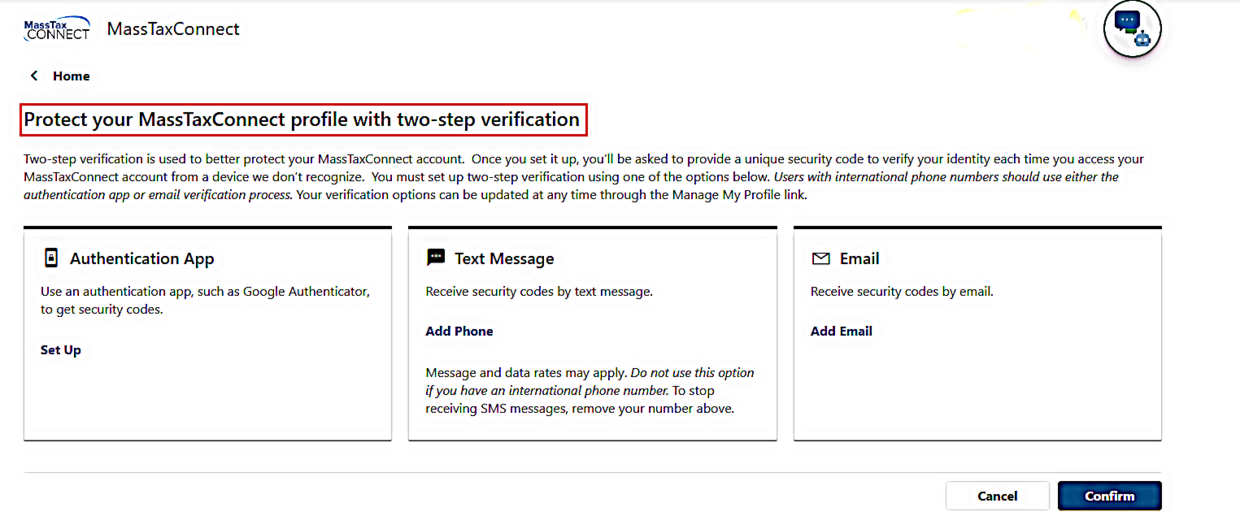

The platform is designed to cater to diverse user needs, offering customizable options for individual taxpayers and businesses alike. For instance, small business owners can utilize mass tax connect to track their sales tax obligations, while freelancers can easily file their income tax returns without the hassle of manual calculations. Additionally, the platform's robust security features, including encryption and multi-factor authentication, safeguard sensitive financial data, ensuring peace of mind for users.

One of the standout features of mass tax connect is its ability to provide real-time updates on tax laws and regulations. This ensures that users remain compliant with the latest changes in state tax policies, reducing the likelihood of errors or penalties. Furthermore, its intuitive interface and comprehensive user guides make it accessible even to those who may not be tech-savvy, thereby democratizing access to essential tax services.

Who Can Benefit from Mass Tax Connect?

While mass tax connect is primarily aimed at residents of Massachusetts, its benefits extend to a wide range of users. Individuals, small businesses, large corporations, and even non-profit organizations can leverage this platform to simplify their tax-related activities. For example, individuals can use mass tax connect to file their personal income tax returns, request refunds, and update their personal information. Similarly, businesses can utilize the platform to manage their sales tax obligations, submit quarterly reports, and resolve any discrepancies with the state tax authorities.

Moreover, the platform caters to specific user groups by offering tailored solutions. Freelancers and gig economy workers, for instance, can benefit from features such as automatic tax calculations and payment reminders, which help them stay on top of their tax responsibilities. Non-profit organizations, on the other hand, can use mass tax connect to streamline their annual reporting requirements and ensure compliance with state regulations. By addressing the unique needs of different user groups, mass tax connect aims to create a more inclusive and equitable tax system for all.

How Does Mass Tax Connect Enhance Transparency?

Transparency is at the core of mass tax connect's design philosophy. By providing users with clear and concise information about their tax obligations, the platform fosters trust and accountability between taxpayers and the government. For instance, users can access detailed breakdowns of their tax liabilities, view historical data on past filings, and track the status of their refunds in real-time. This level of transparency not only empowers users to make informed decisions but also reduces the potential for misunderstandings or disputes with tax authorities.

Read also:Ana Kasparian A Rising Star In Sports Journalism And Beyond

In addition to enhancing transparency, mass tax connect also promotes accountability by enabling users to monitor the performance of state tax services. Through features such as user feedback forms and satisfaction surveys, the platform encourages taxpayers to voice their opinions and suggestions, which can then be used to improve the overall quality of service. This two-way communication channel ensures that the needs and concerns of taxpayers are heard and addressed promptly, further strengthening the relationship between citizens and the government.

Why Should You Use Mass Tax Connect?

The advantages of using mass tax connect are manifold, making it an indispensable tool for anyone dealing with state tax obligations. Firstly, the platform's automation capabilities significantly reduce the time and effort required to complete tax-related tasks. By eliminating the need for manual data entry and calculations, mass tax connect allows users to focus on more critical aspects of their businesses or personal finances. This not only increases productivity but also minimizes the risk of errors, which can lead to costly penalties.

Secondly, mass tax connect offers unparalleled convenience by enabling users to access their tax accounts from anywhere at any time. Whether you're at home, in the office, or traveling, you can log in to the platform and perform tasks such as filing returns, making payments, or checking the status of your refund. This flexibility is particularly beneficial for busy professionals and business owners who may not have the luxury of visiting a tax office in person.

Lastly, the platform's integration with third-party applications and services enhances its functionality and usability. For instance, users can link their accounting software to mass tax connect, allowing for seamless data transfer and synchronization. This interoperability ensures that all relevant information is up-to-date and accurate, further simplifying the tax management process.

What Are the Key Features of Mass Tax Connect?

Mass tax connect boasts a wide array of features designed to meet the diverse needs of its users. Some of the most notable features include:

- Automated tax calculations and filing

- Real-time updates on tax laws and regulations

- Secure payment processing and refund tracking

- Customizable dashboards and reporting tools

- Multi-factor authentication and data encryption

- Integration with third-party accounting software

These features collectively contribute to a more efficient and user-friendly tax management experience, making mass tax connect a valuable asset for taxpayers in Massachusetts.

How Can Mass Tax Connect Save You Time?

Time is a precious commodity, especially for busy professionals and business owners. Mass tax connect helps users save time by automating repetitive tasks and streamlining complex processes. For example, the platform's automated tax calculation feature eliminates the need for manual computations, allowing users to complete their tax filings in a fraction of the time it would take otherwise. Similarly, its ability to generate customized reports and dashboards provides users with quick access to essential information, reducing the time spent on data analysis and decision-making.

In addition to saving time, mass tax connect also enhances accuracy by minimizing the risk of human error. By relying on advanced algorithms and data validation techniques, the platform ensures that all tax-related information is processed correctly and consistently. This not only saves users time but also reduces the likelihood of costly mistakes that could result in penalties or audits.

How Does Mass Tax Connect Impact Businesses?

For businesses, mass tax connect represents a game-changer in the realm of tax management. By offering a comprehensive suite of tools and resources, the platform enables companies to streamline their tax operations and improve their bottom line. For instance, businesses can use mass tax connect to automate their sales tax reporting and payment processes, freeing up valuable resources that can be redirected toward core business activities. This increased efficiency translates into cost savings and improved profitability, making mass tax connect an essential tool for any business operating in Massachusetts.

Furthermore, mass tax connect helps businesses stay ahead of the curve by keeping them informed about the latest developments in state tax policies. Through its real-time updates and notifications, the platform ensures that businesses remain compliant with all applicable regulations, reducing the risk of penalties and legal issues. This proactive approach to tax management not only enhances business performance but also fosters a culture of accountability and responsibility within the organization.

What Are the Potential Drawbacks of Mass Tax Connect?

Despite its many advantages, mass tax connect is not without its limitations. One potential drawback is the learning curve associated with adopting a new platform. For users who are unfamiliar with digital tools or have limited technical expertise, the initial setup and configuration process may seem daunting. However, the platform's comprehensive user guides and customer support resources can help mitigate these challenges, ensuring a smooth transition for all users.

Another concern is the reliance on technology, which can sometimes lead to system outages or technical glitches. While mass tax connect employs robust security measures and backup systems to minimize such risks, occasional disruptions may still occur. In such cases, users may need to rely on alternative methods to complete their tax-related tasks, which could cause delays or inconvenience.

Can Mass Tax Connect Replace Traditional Tax Services?

While mass tax connect offers a wealth of features and benefits, it is unlikely to completely replace traditional tax services in the near future. For many users, particularly those with complex tax situations or specialized needs, consulting with a tax professional may still be necessary to ensure optimal outcomes. However, mass tax connect can serve as a valuable complement to traditional tax services by providing users with the tools and resources they need to manage their tax obligations more effectively. This hybrid approach allows users to enjoy the best of both worlds, combining the convenience of digital tools with the expertise of seasoned professionals.

FAQs About Mass Tax Connect

1. Is Mass Tax Connect Free to Use?

Yes, mass tax connect is free to use for all taxpayers in Massachusetts. The platform is funded by the state government, ensuring that all residents and businesses have equal access to its services without incurring additional costs. However, some third-party applications and services that integrate with mass tax connect may charge fees for their services, so users should be aware of these potential costs.

2. Can I Use Mass Tax Connect for Federal Tax Filings?

No, mass tax connect is specifically designed for state tax filings and does not support federal tax filings. Users who need to file federal tax returns should continue to use the IRS e-file system or consult with a tax professional for assistance. However, mass tax connect can still be a valuable resource for managing state tax obligations, ensuring that users remain compliant with both state and federal regulations.

Conclusion

Mass tax connect has revolutionized the way taxpayers in Massachusetts manage their tax obligations. By offering a comprehensive suite of features and tools, the platform simplifies the tax filing process, enhances transparency, and promotes accountability. While it may have some limitations, the benefits of using mass tax connect far outweigh the drawbacks, making it an indispensable resource for individuals and businesses alike. As the state continues to modernize its tax infrastructure, mass tax connect will undoubtedly play a crucial role in shaping the future of tax management in Massachusetts.

Table of Contents

- What Is Mass Tax Connect?

- Who Can Benefit from Mass Tax Connect?

- How Does Mass Tax Connect Enhance Transparency?

- Why Should You Use Mass Tax Connect?

- What Are the Key Features of Mass Tax Connect?

- How Can Mass Tax Connect Save You Time?

- How Does Mass Tax Connect Impact Businesses?

- What Are the Potential Drawbacks of Mass Tax Connect?

- Can Mass Tax Connect Replace Traditional Tax Services?

- FAQs About Mass Tax Connect

For more information on state tax policies and resources, visit the official Massachusetts Government website.