Mass Tax Connect Login has become a crucial tool for taxpayers in Massachusetts who want to streamline their tax filing process. This digital platform, provided by the Massachusetts Department of Revenue (DOR), allows users to manage their tax-related activities efficiently. Whether you're filing income taxes, checking the status of your refund, or making payments, Mass Tax Connect Login offers a secure and user-friendly interface. With growing concerns over cybersecurity and the convenience of online services, this platform ensures that taxpayers have seamless access to their financial information. In an era where digital transformation is reshaping how we interact with government services, Mass Tax Connect Login stands out as a reliable solution for managing your tax obligations.

For many taxpayers, filing taxes can be a daunting and time-consuming task. However, Mass Tax Connect Login simplifies this process by consolidating all necessary tools and resources into one platform. Users can access their account details, update their information, and even resolve discrepancies without needing to visit a physical office. Moreover, the platform's intuitive design ensures that even those who aren't tech-savvy can navigate it with ease. By adopting Mass Tax Connect Login, taxpayers can save time, reduce errors, and enjoy peace of mind knowing their tax affairs are in order.

As we move further into a digital age, the importance of platforms like Mass Tax Connect Login cannot be overstated. Not only does it offer convenience, but it also enhances transparency and accountability in tax administration. Taxpayers can track their returns, view payment history, and receive notifications about important deadlines. Additionally, the platform is regularly updated with the latest tax laws and regulations, ensuring that users always have access to the most current information. For anyone looking to take control of their tax responsibilities, Mass Tax Connect Login is an invaluable resource.

Read also:What Is Our Rising Sign Unlocking The Secrets Of Astrology

Table of Contents

- What Is Mass Tax Connect Login?

- How Does Mass Tax Connect Login Work?

- Why Should You Use Mass Tax Connect Login?

- How Secure Is Your Data on Mass Tax Connect Login?

- What Are the Benefits of Using Mass Tax Connect Login?

- How Can You Troubleshoot Common Issues with Mass Tax Connect Login?

- Is Mass Tax Connect Login Free to Use?

- How Can You Maximize Your Experience with Mass Tax Connect Login?

What Is Mass Tax Connect Login?

Mass Tax Connect Login is a digital portal designed specifically for Massachusetts residents to handle their tax-related tasks online. It serves as a one-stop solution for all your tax needs, from filing your annual income tax return to making quarterly estimated payments. The platform is part of the Massachusetts Department of Revenue's efforts to modernize and digitize its services, making it easier for taxpayers to manage their obligations without the need for in-person visits or cumbersome paperwork.

This service is accessible via a secure login, which requires users to create an account if they haven't already. Once logged in, taxpayers gain access to a dashboard where they can view their account status, submit forms, and even communicate with DOR representatives. The platform also includes helpful resources such as FAQs, guides, and tutorials to assist users in navigating its features effectively. By leveraging Mass Tax Connect Login, taxpayers can enjoy a more streamlined and efficient tax filing experience.

One of the key advantages of Mass Tax Connect Login is its ability to adapt to the evolving needs of taxpayers. Whether you're an individual filer or a business owner, the platform offers tailored solutions to meet your specific requirements. For instance, businesses can use the platform to file their corporate taxes, manage payroll, and comply with employment tax obligations. This versatility ensures that Mass Tax Connect Login remains a relevant and valuable tool for a wide range of users.

How Does Mass Tax Connect Login Work?

The functionality of Mass Tax Connect Login revolves around its user-friendly interface, which guides taxpayers through every step of the tax filing process. Upon accessing the platform, users are prompted to log in using their credentials. If you're a first-time user, you'll need to create an account by providing basic personal information such as your Social Security number, date of birth, and mailing address. Once your account is set up, you'll receive a unique username and password, which you'll use to access the system moving forward.

Once logged in, the dashboard displays all the essential information related to your tax account. From here, you can initiate various actions, such as filing your tax return, checking the status of your refund, or updating your personal details. The platform also allows you to upload supporting documents, such as W-2 forms or receipts, directly into your account. This feature eliminates the need for physical submissions, saving both time and resources.

In addition to these core functionalities, Mass Tax Connect Login offers advanced features like payment scheduling and electronic filing. These options provide greater flexibility and convenience, enabling taxpayers to manage their obligations on their own terms. Furthermore, the platform sends automated reminders about upcoming deadlines, ensuring that you never miss an important date. By simplifying the tax filing process, Mass Tax Connect Login empowers users to take control of their financial responsibilities.

Read also:Caitlin Clark Moving To Europe A New Chapter For The Star Player

Why Should You Use Mass Tax Connect Login?

There are numerous reasons why Mass Tax Connect Login is worth considering for your tax management needs. First and foremost, it offers unparalleled convenience. Gone are the days when you had to wait in long lines at tax offices or mail in your paperwork. With Mass Tax Connect Login, you can handle everything from the comfort of your home or office, at any time of day. This accessibility is particularly beneficial for individuals with busy schedules or those who live far from DOR offices.

Another significant advantage of using Mass Tax Connect Login is its accuracy. Filing taxes manually can lead to errors, which may result in penalties or delays. By utilizing the platform's built-in tools and automated processes, you can minimize the risk of mistakes and ensure that your return is processed correctly. Additionally, the platform provides real-time updates and feedback, allowing you to address any issues promptly and avoid potential complications.

Finally, Mass Tax Connect Login promotes financial responsibility by giving taxpayers greater visibility into their accounts. You can monitor your payment history, track your refund status, and plan for future obligations more effectively. This transparency fosters a better understanding of your tax responsibilities and helps you make informed decisions about your finances.

How Secure Is Your Data on Mass Tax Connect Login?

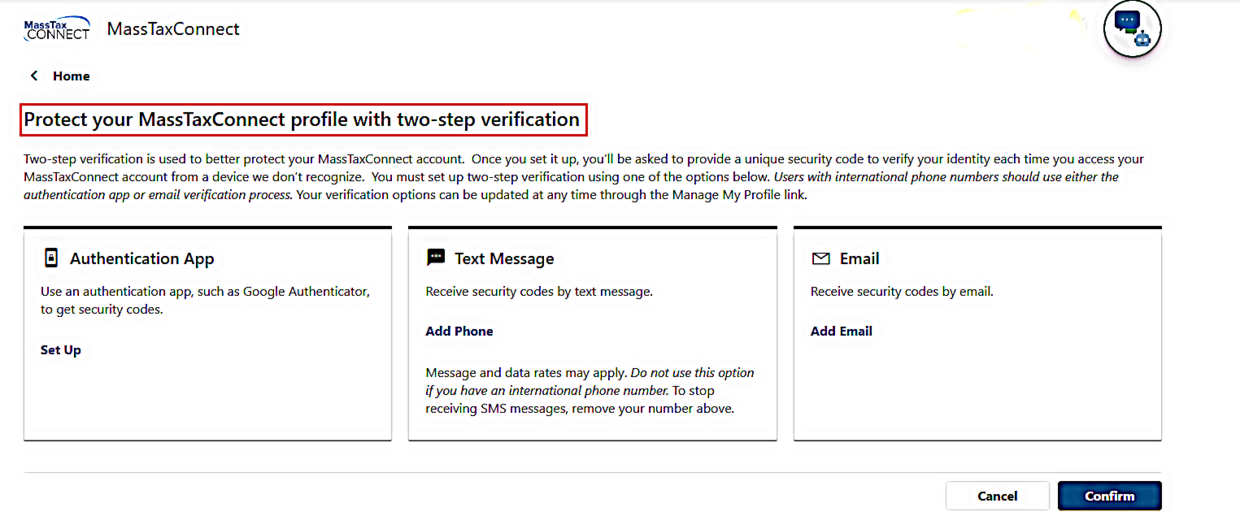

Security is a top priority for Mass Tax Connect Login, as it handles sensitive personal and financial information. To protect your data, the platform employs advanced encryption technologies and multi-factor authentication methods. These measures ensure that only authorized users can access your account and that your information remains confidential at all times.

In addition to technical safeguards, Mass Tax Connect Login adheres to strict regulatory standards set by both state and federal authorities. This compliance ensures that the platform meets the highest levels of data protection and privacy. Furthermore, the Massachusetts Department of Revenue regularly audits the system to identify and address any vulnerabilities, reinforcing its commitment to maintaining a secure environment for its users.

If you ever suspect unauthorized access to your account, Mass Tax Connect Login provides a straightforward process for reporting and resolving the issue. Simply contact the DOR's customer support team, and they will assist you in securing your account and minimizing any potential damage. By prioritizing security, Mass Tax Connect Login instills confidence in its users, encouraging them to embrace digital tax management solutions.

What Are the Benefits of Using Mass Tax Connect Login?

The benefits of Mass Tax Connect Login extend beyond mere convenience and security. One of the most significant advantages is its cost-effectiveness. Unlike hiring a tax professional or purchasing tax preparation software, using the platform is often free or significantly cheaper. This affordability makes it an attractive option for individuals and small businesses looking to save money while still receiving high-quality service.

Another benefit is the platform's educational resources. Mass Tax Connect Login offers a wealth of information to help users better understand their tax obligations and optimize their returns. From step-by-step guides to video tutorials, these resources empower taxpayers to make the most of the platform's features and improve their financial literacy. Additionally, the platform's integration with other DOR services ensures a comprehensive approach to tax management, covering everything from income taxes to property taxes.

Perhaps the greatest benefit of Mass Tax Connect Login is its ability to save time. By automating many of the tasks associated with tax filing, the platform allows users to complete their obligations more quickly and efficiently. This time savings can be reinvested into other areas of your life, whether it's pursuing hobbies, spending time with family, or growing your business. Ultimately, Mass Tax Connect Login transforms what was once a burdensome chore into a manageable and even enjoyable experience.

How Can You Troubleshoot Common Issues with Mass Tax Connect Login?

Even the most well-designed platforms can encounter occasional issues, and Mass Tax Connect Login is no exception. However, the platform provides several tools and resources to help users troubleshoot common problems. For instance, if you're having trouble logging in, check that you're entering your credentials correctly and that your internet connection is stable. If the issue persists, you can reset your password or contact customer support for further assistance.

Another common issue users may face is difficulty uploading documents. To resolve this, ensure that your files are in the correct format and size limits specified by the platform. You may also want to try using a different browser or device to see if the problem is related to your current setup. Additionally, the platform's help center contains a wealth of information on resolving various issues, from technical glitches to account discrepancies.

For more complex problems, Mass Tax Connect Login offers live chat and phone support options. These services connect you directly with trained representatives who can guide you through the troubleshooting process and provide personalized solutions. By leveraging these resources, you can overcome any obstacles and continue using the platform with confidence.

Is Mass Tax Connect Login Free to Use?

One of the most frequently asked questions about Mass Tax Connect Login is whether it's free to use. The answer depends on the specific services you're accessing. For basic functionalities such as viewing your account information or checking the status of your refund, there is no charge. However, certain advanced features, like electronic filing or payment processing, may incur fees. These fees are generally lower than those associated with third-party providers, making Mass Tax Connect Login a cost-effective option for many users.

It's important to note that the platform's pricing structure is transparent, with all costs clearly outlined before you proceed with any transaction. This transparency ensures that users are fully aware of any potential charges and can make informed decisions about how they wish to use the platform. Furthermore, the Massachusetts Department of Revenue occasionally offers promotions or discounts, which can further reduce the cost of using Mass Tax Connect Login.

How Can You Maximize Your Experience with Mass Tax Connect Login?

To get the most out of Mass Tax Connect Login, it's essential to familiarize yourself with all its features and capabilities. Start by exploring the platform's dashboard to understand the various options available to you. Take advantage of the educational resources provided, such as tutorials and guides, to enhance your knowledge and proficiency. Regularly updating your personal information and enabling notifications can also help you stay on top of your tax responsibilities.

Another way to maximize your experience is by leveraging the platform's advanced features. For example, scheduling payments in advance can help you avoid late fees and ensure timely compliance with tax deadlines. Similarly, using the electronic filing option can expedite the processing of your return and reduce the likelihood of errors. By taking full advantage of these tools, you can streamline your tax management process and achieve greater efficiency.

Finally, don't hesitate to reach out to customer support if you have any questions or need assistance. The team at Mass Tax Connect Login is dedicated to helping users succeed and will provide the guidance you need to make the most of the platform. With a little effort and exploration, you can unlock the full potential of Mass Tax Connect Login and transform your tax filing experience.

What Are Some Common Misconceptions About Mass Tax Connect Login?

Despite its many advantages, Mass Tax Connect Login is sometimes misunderstood by users. One common misconception is that the platform is only suitable for tech-savvy individuals. In reality, its intuitive design makes it accessible to users of all skill levels. Another misconception is that the platform is prone to technical issues. While no system is immune to glitches, Mass Tax Connect Login has a robust support network in place to address any problems quickly and effectively.

Can Mass Tax Connect Login Help with Business Taxes?

Absolutely! Mass Tax Connect Login offers a range of features specifically designed for business owners. These include tools for filing corporate taxes, managing payroll, and complying with employment tax regulations. By utilizing these resources, businesses can simplify their tax management processes and ensure compliance with all relevant laws and regulations.

FAQs

1. How Do I Reset My Password for Mass Tax Connect Login?

To reset your password, navigate to the login page and select the "Forgot Password" option. Follow the prompts to verify your identity and create a new password. Ensure that your new password is strong and secure to protect your account.

2. Is Mass Tax Connect Login Available on Mobile Devices?

Yes, Mass Tax Connect Login is optimized for mobile devices, allowing you to access your account and manage your tax obligations on the go. Simply visit the platform's website using your smartphone or tablet, and log in as usual.

3. What Should I Do If I Can't Access My Account?

If you're unable to access your account, try resetting your password or contacting customer support for assistance. Ensure that your internet connection is stable and that you're entering your credentials correctly.