Navigating tax-related issues can be challenging, particularly when it comes to the wait times at the Pinellas County Tax Collector's office. Whether you're dealing with vehicle registration renewals, property tax payments, or other tax-related matters, understanding the factors that influence wait times is essential for a smoother experience. This article aims to provide you with comprehensive insights into Pinellas County tax collector wait times, practical tips to minimize delays, and strategies to prepare effectively for your visit.

Pinellas County, one of Florida's most densely populated regions, serves a significant number of residents annually through its tax collector's office. The efficiency of these services directly affects the community's overall satisfaction and productivity. Gaining a deeper understanding of the factors contributing to wait times is crucial for planning your visit and ensuring a more streamlined experience.

In this article, we will explore everything you need to know about Pinellas County tax collector wait times. From analyzing historical data to offering actionable advice, our goal is to help you save time and effort when interacting with the tax collector's office. Let’s get started!

Read also:Michael Caines The Culinary Maestro Redefining Fine Dining

Exploring Services Offered by the Pinellas County Tax Collector

Prior to discussing wait times, it is important to familiarize yourself with the diverse range of services provided by the Pinellas County Tax Collector's office. These include vehicle registration, tax payments, and various other administrative tasks. Understanding these offerings will not only help you prepare for your visit but also enhance your overall experience.

Some of the primary services provided by the office are:

- Vehicle registration and title transfers

- Property tax payments

- Hunting and fishing licenses

- Driver's license services

Having a clear idea of the specific service you require will allow you to estimate the potential wait time and select the optimal time for your visit.

Key Factors Influencing Wait Times at the Tax Collector's Office

Several variables contribute to the wait times experienced at the Pinellas County Tax Collector's office. Gaining insight into these factors can empower you to better anticipate and manage delays, ensuring a more efficient visit.

Seasonal and Hourly Peaks

Seasonal and hourly fluctuations significantly impact wait times. For example, the end of the year tends to be a busy period for tax payments, while the beginning of the school year sees a surge in vehicle registration renewals. Scheduling your visit outside of these peak periods can considerably reduce your wait time.

Staff Availability and Scheduling

The availability of staff members also plays a critical role in determining wait times. During periods of staff shortages or training sessions, wait times may increase. Keeping an eye on the office's schedule and announcements can assist you in planning your visit more effectively.

Read also:Vk Tickle A Comprehensive Guide To Understanding Its Popularity And Features

Insights from Historical Wait Time Data

Historical data provides invaluable insights into the average wait times at the Pinellas County Tax Collector's office. By carefully analyzing this data, we can identify trends and patterns that may assist in predicting future wait times.

According to recent studies, the average wait time during non-peak hours typically falls between 15-20 minutes. However, during peak hours, this duration can extend to 45 minutes or longer. Leveraging this data can help you strategize your visit to minimize delays and maximize efficiency.

Practical Strategies to Minimize Wait Times

Here are some actionable tips to help you reduce wait times when visiting the Pinellas County Tax Collector's office:

- Visit During Off-Peak Hours: Early mornings or late afternoons tend to have shorter lines, making them ideal times to visit.

- Utilize Online Services: Many services, such as property tax payments, can be conveniently completed online, saving you both time and effort.

- Monitor the Office’s Website: Stay updated with real-time information regarding wait times and service availability.

- Prepare All Necessary Documents: Having all required documents ready can expedite the process and reduce your overall wait time.

Pinellas County Tax Collector Locations and Contact Details

Pinellas County offers multiple tax collector locations to better serve its residents. Knowing the location nearest to you and their contact information can greatly enhance the convenience of your visit.

Clearwater Office

The Clearwater office is one of the busiest locations, offering a wide array of services. Below are the contact details and address:

- Address: 314 N Fort Harrison Ave, Clearwater, FL 33755

- Phone: (727) 464-3400

Saint Petersburg Office

The Saint Petersburg office is another popular option for residents in the southern part of the county.

- Address: 330 2nd Ave NE, St Petersburg, FL 33701

- Phone: (727) 893-7500

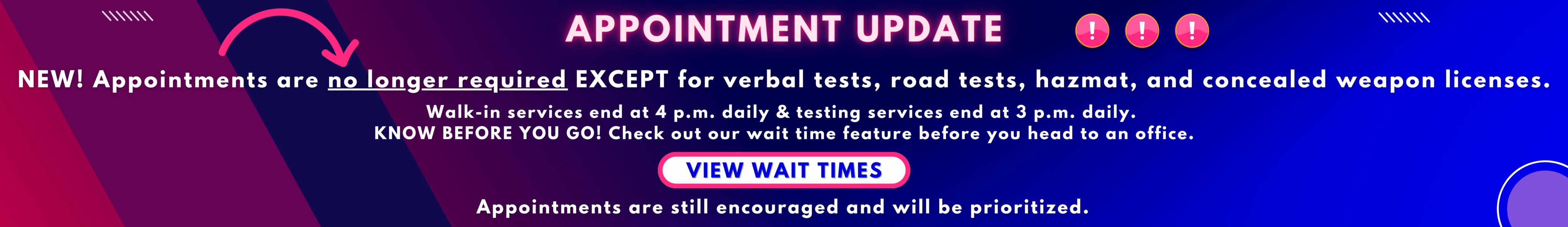

Technological Advancements and Online Services

Technology has transformed the way we interact with government services, offering numerous conveniences. The Pinellas County Tax Collector's office provides several online services designed to help you avoid long wait times.

Secure Online Payment Solutions

For services like property tax payments, the office offers secure online payment options. This not only saves time but also ensures convenience and safety for all users.

Real-Time Wait Time Notifications

The office’s website provides real-time updates on wait times across all locations. Checking these updates before your visit can help you choose the most convenient time to go.

Customer Feedback and Community Reviews

Customer feedback and reviews play a pivotal role in enhancing the quality of services. By analyzing feedback, the Pinellas County Tax Collector's office can pinpoint areas for improvement and implement necessary changes to elevate the customer experience.

Recent reviews indicate that most customers appreciate the efficiency and professionalism of the staff. However, some have expressed concerns regarding wait times during peak hours, highlighting the need for ongoing optimization.

Legal and Regulatory Compliance

Understanding the legal and regulatory aspects of tax-related services is essential. The Pinellas County Tax Collector's office adheres to stringent regulations to ensure transparency and fairness in all transactions.

Florida’s Property Tax Legislation

Florida's property tax laws outline the methodology for calculating and collecting property taxes. Familiarizing yourself with these laws can provide a clearer understanding of your tax obligations and responsibilities.

Ongoing Improvements and Future Initiatives

The Pinellas County Tax Collector's office is committed to ongoing improvements aimed at reducing wait times and enhancing customer satisfaction. These initiatives include expanding online services, enhancing staff training, and integrating innovative technological solutions.

Final Thoughts

In summary, understanding Pinellas County tax collector wait times involves considering various factors such as peak hours, staff availability, and historical data. By following the practical tips outlined in this article, you can significantly reduce your wait times and enjoy a more efficient and stress-free experience.

We invite you to share your thoughts and experiences in the comments section below. Your feedback is invaluable in helping us improve and provide more relevant content. Additionally, feel free to explore our other articles for further insights into tax-related matters.

Table of Contents

- Exploring Services Offered by the Pinellas County Tax Collector

- Key Factors Influencing Wait Times

- Insights from Historical Wait Time Data

- Practical Strategies to Minimize Wait Times

- Pinellas County Tax Collector Locations and Contact Details

- Technological Advancements and Online Services

- Customer Feedback and Community Reviews

- Legal and Regulatory Compliance

- Ongoing Improvements and Future Initiatives

- Final Thoughts