Money orders serve as a reliable financial tool for secure transactions, and one of the key elements ensuring their validity is the serial number present on each money order. Whether you're a first-time user or someone who regularly employs money orders, understanding the significance of the serial number is crucial. This unique code not only verifies the legitimacy of the document but also aids in tracking its journey.

Many users often underestimate the importance of the serial number, yet it acts as a safeguard against fraudulent activities. Learning how to identify and validate this number can significantly reduce the risk of scams and enhance the security of your transactions.

In this comprehensive guide, we will explore the concept of serial numbers on money orders in greater detail. We will delve into their purpose, methods for locating them, and their role in maintaining financial integrity. Let's dive in!

Read also:Find Your Rising Sign And Moon Sign Unlock The Secrets Of Your Zodiac Profile

Table of Contents

- What Is a Money Order?

- Why the Serial Number Matters

- How to Find the Serial Number

- Types of Money Orders and Their Serial Number Formats

- Security Features of Money Orders

- Tracking the Status of Your Money Order

- Guarding Against Money Order Fraud

- Legal Considerations for Money Orders

- Frequently Asked Questions About Serial Numbers

- Conclusion

What Is a Money Order?

A money order is a prepaid payment instrument that functions much like a check but offers a higher level of security. It is widely used in situations where cash or personal checks are not acceptable, such as paying bills, rent, or engaging in transactions where the recipient demands guaranteed funds. Unlike traditional checks, money orders are not linked to bank accounts, making them an ideal choice for individuals without access to banking services.

Money orders are available in various denominations, with a typical limit of $1,000 per order in the United States. They can be purchased from numerous locations, including post offices, grocery stores, and financial institutions. Once issued, the money order becomes a legal document that must be handled with utmost care to ensure its safety and validity.

Key Characteristics of Money Orders

- Prepaid: Funds must be provided upfront when purchasing a money order, ensuring that the recipient receives payment immediately.

- Secure: Money orders are less vulnerable to fraud compared to personal checks, offering peace of mind to both the sender and the recipient.

- Universal: Accepted by most businesses and individuals, money orders are regarded as a dependable payment method in a variety of transactions.

Why the Serial Number Matters

The serial number on a money order serves as a unique identifier for each document, playing a pivotal role in verifying its authenticity and tracking its status throughout its lifecycle. Without a valid serial number, confirming whether a money order is genuine or counterfeit becomes exceedingly difficult. This number acts as a digital fingerprint, ensuring the document's legitimacy and protecting against fraud.

Financial institutions and businesses rely heavily on serial numbers to ensure that money orders have not been tampered with or duplicated. Moreover, the serial number enables issuers to monitor the movement of the money order from the point of purchase to its final destination, providing transparency and accountability in financial transactions.

How Serial Numbers Combat Fraud

- Each money order is assigned a unique serial number, making it challenging for counterfeiters to replicate the document.

- Issuers can cross-check serial numbers against their databases to detect and prevent fraudulent activities.

- Recipients can verify the authenticity of the money order by confirming the serial number with the issuing entity, ensuring the transaction's integrity.

How to Find the Serial Number

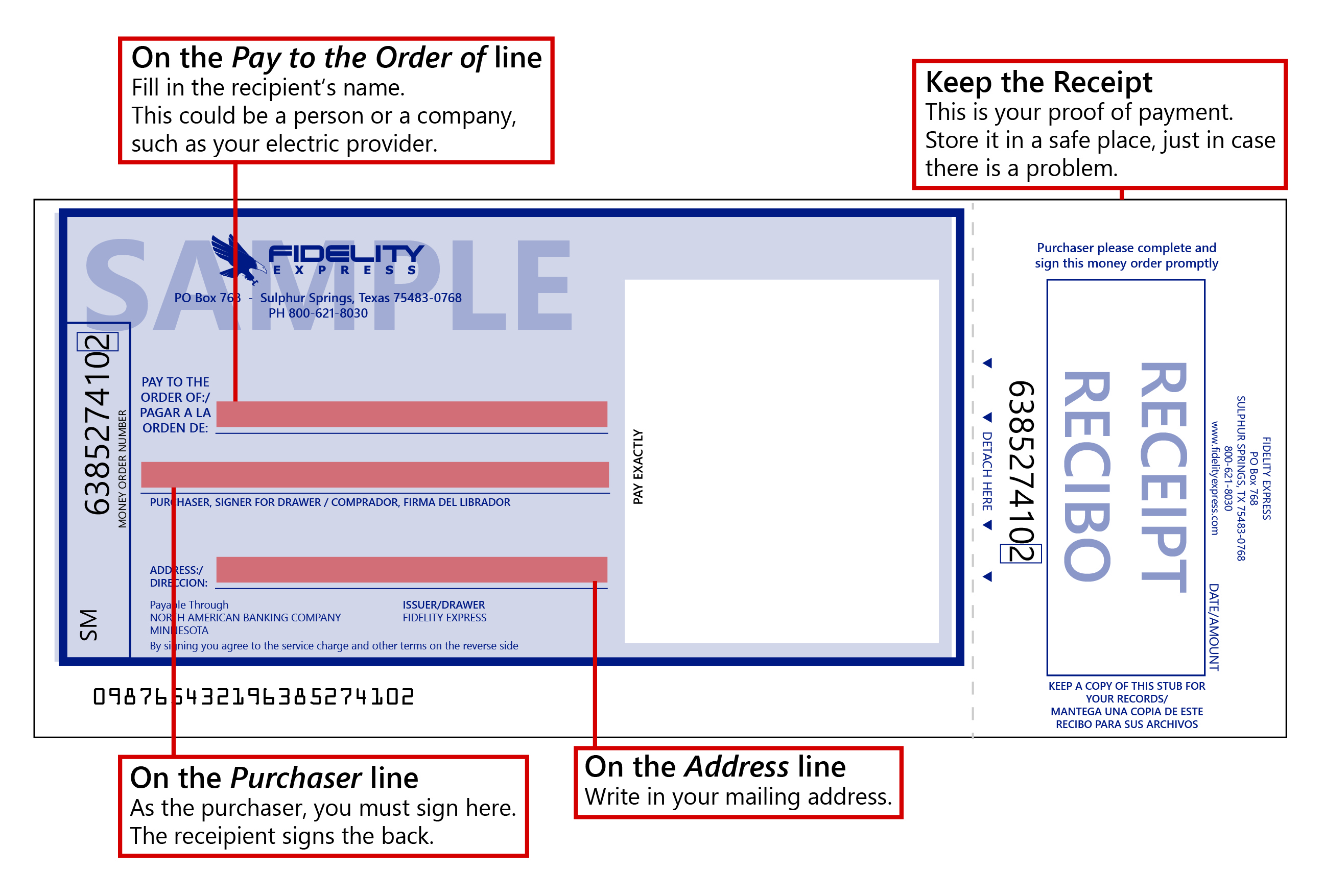

Locating the serial number on a money order is a straightforward process, though the exact placement may vary depending on the issuer. Typically, the number is situated either in the top right or bottom left corner of the document. In some cases, the serial number may appear in multiple locations for enhanced security. For instance, U.S. Postal Service money orders display the serial number in the top right corner, while Western Union money orders often include it near the barcode at the bottom of the document.

To ensure accurate identification, always consult the specific guidelines provided by the issuer. Familiarizing yourself with these details will help you locate the serial number quickly and efficiently.

Read also:Emory Tate Height A Comprehensive Look Into The Life And Career Of A Chess Legend

Tips for Identifying the Serial Number

- Look for a sequence of numbers ranging from 8 to 12 digits, as this is the standard format for most money order serial numbers.

- Examine both the front and back of the money order for any additional identifiers that may accompany the primary serial number.

- Compare the serial number with any accompanying receipts or purchase confirmations to ensure consistency and accuracy.

Types of Money Orders and Their Serial Number Formats

Money orders come in various forms, each featuring its own serial number format. Understanding these differences can aid in identifying and verifying the authenticity of your money order. Below, we explore some of the most common types of money orders and their respective serial number conventions:

U.S. Postal Service Money Orders

Issued by the United States Postal Service, these money orders feature an 11-digit serial number prominently displayed in the top right corner. The number is printed in bold, making it easy to locate and identify.

Western Union Money Orders

Western Union money orders utilize a 10-digit serial number, typically found near the barcode at the bottom of the document. This format remains consistent across all Western Union locations worldwide, ensuring uniformity and reliability.

MoneyGram Money Orders

MoneyGram money orders employ a 9-digit serial number, usually printed in the bottom left corner. Similar to other issuers, MoneyGram incorporates additional security features to prevent forgery and enhance the document's credibility.

Security Features of Money Orders

In addition to the serial number, money orders incorporate several advanced security features to ensure their integrity. These features are designed to deter counterfeiters and provide confidence to both buyers and recipients. Some of the most notable security features include:

- Watermarks: Invisible designs that become visible when the document is held up to light, adding a layer of protection against forgery.

- Security threads: Embedded threads that glow under ultraviolet light, further enhancing the document's authenticity.

- Holograms: Three-dimensional images that are difficult to replicate, ensuring the money order's validity.

- Ink that changes color: Special ink used in printing that shifts color when viewed from different angles, adding an additional layer of security.

Why Security Features Are Crucial

These security measures are vital in maintaining the reliability of money orders. By integrating multiple layers of protection, issuers can minimize the risk of fraud and ensure that transactions remain secure. Always inspect your money order for these features before completing any transaction to safeguard your financial interests.

Tracking the Status of Your Money Order

One of the significant advantages of the serial number on a money order is its ability to track the document's status. Whether you're awaiting confirmation of payment or need to verify that the money order has been cashed, the serial number provides the necessary information to do so. Most issuers offer online tracking services, allowing users to input their serial number and receive real-time updates on the money order's status.

This feature is particularly beneficial for businesses and individuals who require proof of payment for record-keeping purposes. By leveraging the serial number, you can gain valuable insights into the progress of your transaction and ensure its successful completion.

Steps to Track a Money Order

- Locate the serial number on your money order, ensuring it is accurate and legible.

- Visit the official website of the issuer and navigate to the tracking page, where you can input the serial number.

- Enter the serial number along with any additional required information, following the instructions provided by the issuer.

- Review the status update provided by the system, confirming the current state of your money order.

Guarding Against Money Order Fraud

While money orders are generally considered secure, they are not entirely immune to fraud. Scammers frequently attempt to exploit unsuspecting individuals by presenting counterfeit money orders or engaging in deceptive practices. To protect yourself, always adhere to the following best practices:

- Carefully inspect the money order for security features before accepting it, ensuring its authenticity.

- Verify the serial number with the issuing entity to confirm that the document is genuine and legitimate.

- Avoid accepting money orders for amounts exceeding the agreed-upon payment, as this is a common tactic used in overpayment scams.

- Exercise caution when sending money orders to unfamiliar individuals or businesses, prioritizing transactions with trusted parties.

Common Fraud Schemes Involving Money Orders

Some of the most prevalent money order fraud schemes include overpayment scams, where the sender deliberately sends a money order for an excessive amount and requests a refund, and counterfeit money orders that closely mimic legitimate documents. Staying informed about these tactics can help you identify potential scams and safeguard your financial well-being.

Legal Considerations for Money Orders

Money orders are governed by a range of laws and regulations designed to protect consumers and uphold financial integrity. In the United States, the Consumer Financial Protection Bureau (CFPB) oversees the issuance and use of money orders, ensuring compliance with federal guidelines. Additionally, state laws may impose further requirements on money order issuers, such as mandatory disclosures and fee limitations.

Understanding these legal frameworks is essential for both buyers and recipients to ensure their rights are protected and their transactions remain secure. Familiarizing yourself with these regulations can empower you to make informed financial decisions and address any issues that may arise.

Consumer Protections

- Right to Receive a Receipt: You are entitled to a receipt upon purchasing a money order, serving as proof of purchase and aiding in tracking its status.

- Ability to Track Status: The serial number allows you to monitor the progress of your money order, providing transparency and accountability in your transactions.

- Access to Dispute Resolution: In the event of fraud or errors, you have the right to engage in dispute resolution processes to address and resolve any issues that may arise.

Frequently Asked Questions About Serial Numbers

Here are some commonly asked questions about serial numbers on money orders:

Q: Can I cash a money order without the serial number?

A: No, the serial number is a critical component for verifying the authenticity of the money order. Without it, most financial institutions will not process the document, as it lacks the necessary identification to confirm its legitimacy.

Q: What should I do if I lose my money order?

A: If you misplace your money order, contact the issuer immediately and provide them with the serial number to initiate a replacement process. Be prepared to pay a small fee for this service, as it ensures the security and integrity of the replacement document.

Q: Are all serial numbers the same length?

A: No, the length of the serial number varies depending on the issuer. For example, U.S. Postal Service money orders feature 11-digit serial numbers, while Western Union money orders use 10-digit numbers, reflecting the diverse formats employed by different issuers.

Conclusion

In conclusion, the serial number on a money order is a fundamental element that ensures the document's authenticity and security. By comprehending its purpose and learning how to locate and verify it, you can protect yourself from fraud and ensure the success of your transactions. Understanding the role of the serial number empowers you to make informed financial decisions and maintain the integrity of your transactions.

We encourage you to share this article with others who may benefit from the information provided. If you have any questions or feedback, please leave a comment below. Additionally, explore our other articles for further insights into financial instruments and best practices to enhance your financial literacy.