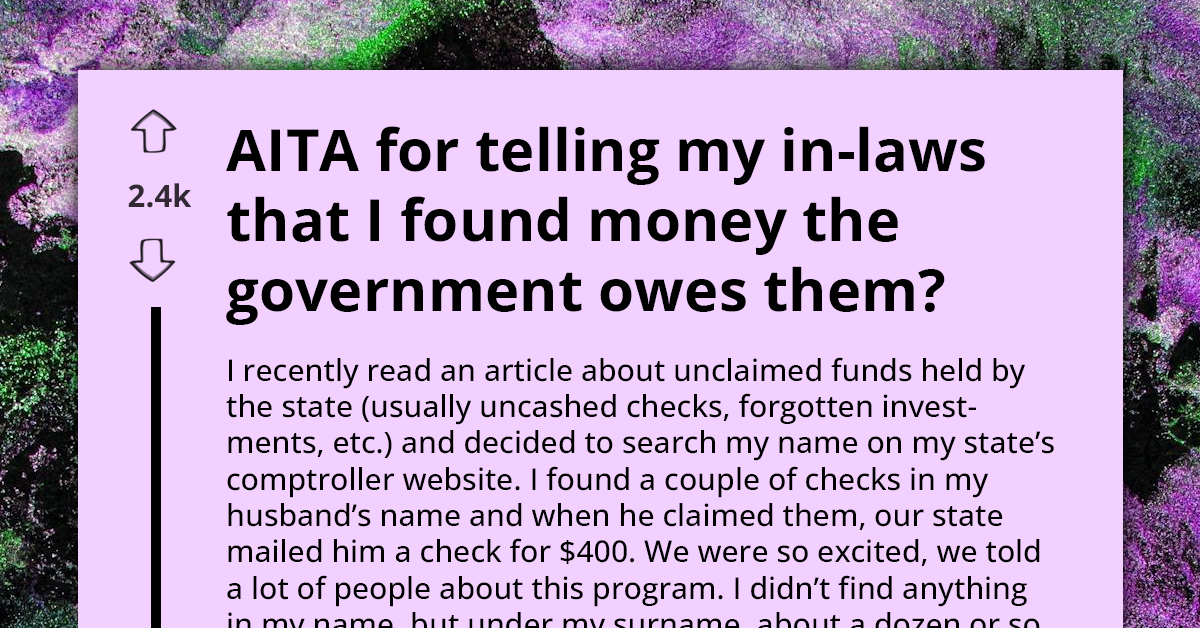

Searching for unclaimed money has gained significant attention in recent years, as more people uncover forgotten funds, unclaimed benefits, and hidden assets. Billions of dollars remain untouched in government accounts, financial institutions, and corporate reserves, often belonging to individuals who are unaware of their existence. This detailed guide aims to simplify the process of locating and reclaiming unclaimed money, offering practical advice and expert strategies to help you navigate the system effectively.

Whether you're searching for lost savings accounts, forgotten insurance policies, or unclaimed inheritances, understanding the mechanisms behind unclaimed money is essential. This article will guide you through identifying potential sources of unclaimed funds, utilizing free search tools, and effectively filing claims to recover what is rightfully yours.

Our objective is to equip you with the knowledge and resources needed to reclaim lost assets. By following the strategies outlined in this guide, you can tap into the vast pool of unclaimed money and potentially enhance your financial well-being significantly.

Read also:Naughty America The Ultimate Guide To Exploring The World Of Adult Entertainment

Table of Contents

- What Exactly is Unclaimed Money?

- Why Does Unclaimed Money Accumulate?

- How to Conduct a Free Search for Unclaimed Money

- Common Sources of Unclaimed Money

- Tools for Searching Unclaimed Money

- Important Legal Considerations

- How to Claim Your Unclaimed Money

- Preventing Assets from Becoming Unclaimed

- Statistics and Current Trends

- Final Thoughts

What Exactly is Unclaimed Money?

Unclaimed money refers to financial assets that have been separated from their rightful owners due to various reasons, such as changes in address, forgotten accounts, or lack of communication. These funds are typically held by state governments, financial institutions, or corporations until they are claimed by the rightful owner or their heirs. A free search for unclaimed money allows individuals to locate and reclaim these lost assets without incurring any costs.

Types of Unclaimed Money

The scope of unclaimed money is extensive and can encompass a wide range of assets, including:

- Savings and checking accounts

- Pension benefits

- Life insurance policies

- Stock dividends

- Utility refunds

Why Does Unclaimed Money Accumulate?

The accumulation of unclaimed money can be attributed to several factors, including:

- Address Changes: Relocating without updating personal records can lead to lost communication regarding accounts and benefits.

- Forgotten Accounts: People often forget about old bank accounts or investments, especially if they haven't been accessed for years.

- Estate Settlement Issues: Beneficiaries may remain unaware of assets left behind by deceased relatives, leading to unclaimed inheritances.

How to Conduct a Free Search for Unclaimed Money

Performing a free search for unclaimed money is easier than you might imagine. With the right tools and resources, anyone can conduct a thorough investigation into potential unclaimed funds. This process empowers individuals to take control of their financial recovery journey.

Steps to Conduct a Free Search

- Gather essential personal information, such as Social Security numbers, addresses, and dates of birth.

- Visit official state unclaimed property websites to initiate your search.

- Utilize federal databases like the Pension Benefit Guaranty Corporation (PBGC) to locate missing pensions.

Common Sources of Unclaimed Money

Understanding the most common sources of unclaimed money is critical for a successful search. Below are some prevalent categories:

Bank Accounts

Many individuals have forgotten savings or checking accounts that have been inactive for years. These accounts are eventually turned over to state treasuries as unclaimed property, making them a prime target for recovery efforts.

Read also:Exploring The Tickle Community Vk A Comprehensive Guide

Tools for Searching Unclaimed Money

A variety of reliable tools and platforms are available to assist in your search for unclaimed money. Some of the most trusted resources include:

- National Association of Unclaimed Property Administrators (NAUPA): A centralized database connecting users to state-specific resources.

- MissingMoney.com: A multi-state search tool endorsed by NAUPA, providing a convenient platform for locating unclaimed assets.

Important Legal Considerations

When engaging in a search for unclaimed money, it's crucial to be aware of the legal framework governing these assets. Each state has its own laws regarding escheatment periods and claim processes. For complex cases involving inheritance or large sums of money, consulting with a legal professional may be necessary to ensure compliance and maximize your chances of success.

How to Claim Your Unclaimed Money

Once you've identified potential unclaimed funds, the next step is filing a claim. This typically involves submitting documentation to prove your identity and ownership rights. Depending on the amount and type of asset being reclaimed, additional verification steps may be required.

Documentation Required

- Photo ID

- Proof of address

- Death certificates (for estate claims)

Preventing Assets from Becoming Unclaimed

Preventing assets from becoming unclaimed is vital for maintaining financial stability. Regularly updating contact information with financial institutions and maintaining detailed records of all accounts and investments can help ensure that your assets remain secure and accessible.

Statistics and Current Trends

The scale of unclaimed money is staggering. Recent estimates indicate that billions of dollars in unclaimed funds are held by state treasuries across the United States. This figure continues to grow as more accounts go dormant and people move without updating their information, underscoring the importance of proactive searches.

Final Thoughts

Searching for unclaimed money represents a valuable opportunity for individuals to recover lost assets and improve their financial situation. By following the steps outlined in this guide and leveraging the available resources, you can successfully navigate the process of reclaiming what is rightfully yours.

We encourage you to take the first step today by initiating your own search for unclaimed money. Share this guide with friends and family to help them discover potential funds they may be entitled to. Your journey to financial discovery begins here!